Can you answer these HVAC job pricing questions quickly?

-> Do you price jobs using a consistent method?

-> Do you know your direct labor and materials on every job? (Cost of Goods Sold).

-> Do you know your annual overhead? (Fixed costs you must cover every month).

-> Are you shooting at a target profit or cash flow on every job?

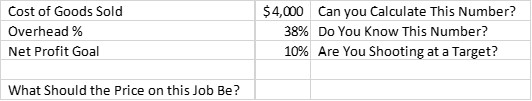

If not, you’re probably dying a death by a thousand cuts every hour/day/week/month/year. How can you fix this? Let’s take a simple example for an installation. How should you price this job?

If you don’t know your Cost of Goods Sold (direct labor and materials), overhead percentage, and net profit goal per job, please stop right here. You should be able to get the first two from your accounting system. If not, it’s broken and please contact me right away. The 10% profit goal was one I set, and I’ll explain why it’s reasonable in a moment.

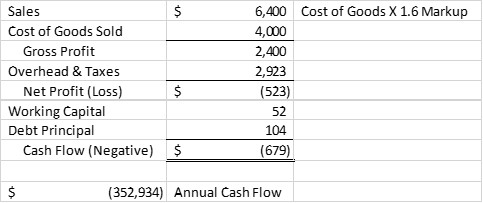

Let’s say you used a “markup” method. This is common and why it’s often dangerous.

Using a 1.6X Cost of Goods Sold markup ($4,000 X 1.6) resulted in this HVAC business losing $679 of cash on this installation job. If they did this 10 times a week for 52 weeks, the installation portion of their business would burn through $353,000 of cash in a year. This is, unfortunately, what a lot of HVAC businesses that don’t survive do.

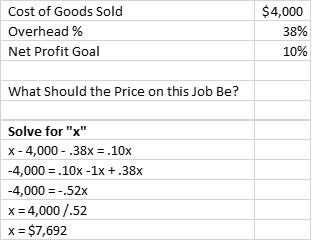

Let’s dust off those algebra skills and try another method. Please be patient. I’m going to make this very easy at the end – no algebra required.

Solving for “x”, we determined the price on this job should be $7,692 to hit our target 10% profit. Does this work? Let’s find out.

Pricing this job at $7,692 allowed this HVAC company to hit the 10% profit goal. More importantly, they hit positive cash flow of 7% which will allow them to reinvest cash back into the business and pay owner dividends. This is why 10% is a good profit target to start with on installs, especially if you’re way below it. You can always crank it up later as you get better at the method and continue to deliver outstanding service. This was a $633,000 increase in annual cash flow over the markup method!

I said I was going to make this easy. Once you nail down the Cost of Goods Sold, Overhead, and Profit Target, it’s very simple. Do you see the percentage of Cost of Goods Sold? 52% can now be used for single factor pricing. You’ll want to model your exact numbers and target before implementing this.

$4,000 Cost of Goods Sold / 0.52 = $7,692

From here, as long as you can correctly calculate your direct labor and materials (Cost of Goods Sold) you expect on the installation, know your overhead rate, and have your target profit, you can use your single factor (in this case only, 0.52) to price installation jobs. You’ll want to monitor this to make sure it’s delivering the profit you want, particularly since the prices of everything go up. Let me know if you want help implementing this in your HVAC business.

Please buy this book if you haven’t already. This isn’t an affiliate link and I receive no royalties.

Thanks,

Josh

Sign up for this blog here if you want tools to increase the value of your business or want a refreshing view on business valuation from a recovering CPA. I’m Josh Horn, CPA, CVA of Horn Valuation. I value businesses for growth and exits with a focus on HVAC and trade contractors. I also assist litigation and divorce attorneys as a business valuation consulting or testifying expert. My clients are business owners and attorneys. If you’d like more information, email me at [email protected], or call me at 217-649-8794.

I’m a licensed Certified Public Accountant (CPA) and credentialed in business valuation (CVA). I’ve been a tax and business consultant in a top 100 CPA firm and a controller in a large international company. I’ve also valued and advised small family-owned and multimillion-dollar companies. You can connect with me here on LinkedIn, Facebook, Twitter, YouTube and Instagram.

“Once-in-a-lifetime events demand an expert.”

Josh Horn, CPA and Certified Valuation Analyst